1. Trade Disputes With Benin

In August, Nigeria closed its border with Benin in an effort to stop smuggled goods from flowing across the border, and to bolster domestic farming. In particular, the Nigerian government would like to become self-sufficient in the production of rice, on which Nigerians spend almost $4 billion each year. For Benin, for which 20% of its GDP is based on exports and imports to and from Nigeria, and whose economy is heavily agrarian, this has been challenging. France 24 news spotted tomatoes rotting by the roads in Benin, which would have previously been destined for export to Nigeria.

Read the article “Rotten Tomatoes Line Roads in Benin after Nigeria Closes Border” from France 24.

2. Nigeria Aims to Raise Revenue by Claiming a Larger Share of Oil Profits

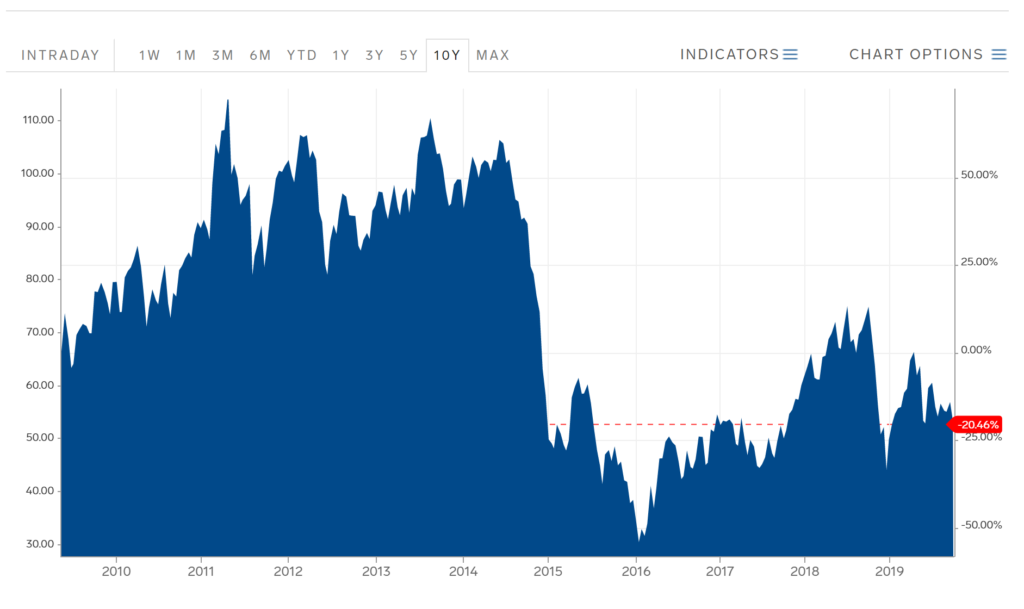

Oil is cheap! The price of crude oil is $53.81 per barrel.

The bulk of Nigeria’s government revenue is derived from oil sales. A supreme court decision last year ruled that the government has the ability to retroactively collect profit from oil companies participating in deep offshore oil drilling. Under the current production sharing law, firms are required to share 20% of their profits from deep offshore oil fields with the government. Now, the government argues that since oil is trading at over $10 per barrel, it is owed a greater portion of revenue. They are seeking $62 billion, but will likely settle for less. Oil companies are challenging the fine.

Read the article “Nigeria Demands $62 Billion from Oil Majors for Past Profits” from Bloomberg.

3. A Domestic Note – More Brokerages Offer Free Trading

Recently, competition in the free trades space has been heating up. I’m still using my favorite, Robinhood, but as more firms begin to offer free trading, I will be looking to see if there are any new opportunities to access more opportunities in an easy, low cost manner.